cash frenzy 👀 Cash Frenzy: The Allure and Risks of Instant Wealth

Cash Frenzy: The Allure and Risks of Instant Wealth

Imagine waking up one day to find your life has changed overnight. You check your phone, and there it is—a notification from your bank that your account balance has skyrocketed. You scroll down your feed, and the headlines scream about the latest cash frenzy sweeping the nation. Everyone seems to be cashing in, and suddenly, the notion of wealth feels tantalizingly within reach. But hold on! Is this whirlwind of quick money a dream come true, or a recipe for disaster?cash frenzy

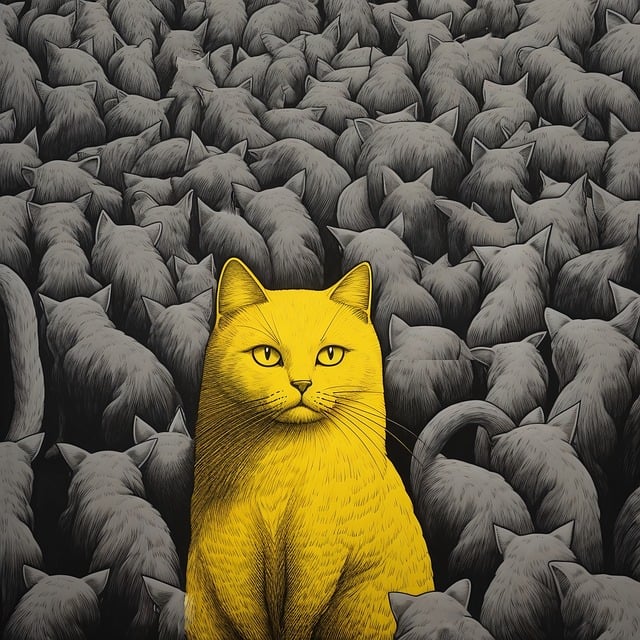

In today’s world, the allure of instant wealth is stronger than ever. Social media platforms have transformed the way we view finances, and the viral trend of cash windfalls has taken the internet by storm. Whether it’s the latest cryptocurrency boom, a popular stock that seems to defy gravity, or the latest viral challenge promising to make you rich, the idea of striking gold with minimal effort has become irresistible.

People are sharing their stories of financial triumph, showcasing extravagant purchases, and flaunting lifestyles that seem pulled straight from a movie. The images of luxury yachts, exotic vacations, and designer wardrobes flood our feeds, creating a virtual frenzy. The question is: how many of these stories are the real deal, and how many are just smoke and mirrors? cash frenzy

We’ve all heard the adage, “If it sounds too good to be true, it probably is.” Yet, the siren call of easy money continues to lure countless individuals into its web. The truth is, while many have struck it rich, an equally significant number have found themselves on the losing end of the cash frenzy. The rise and fall of fortune can be as swift as a viral TikTok dance, leaving many in its wake.

One of the most significant players in this modern cash game is cryptocurrency. The dramatic fluctuations in value can create millionaires overnight, but they can just as easily wipe out fortunes in an instant. The stories of those who bought Bitcoin when it was still a novelty and are now living their best lives are legendary. In contrast, the cautionary tales of individuals who invested their life savings in dubious coins are also alarmingly common.

Then there’s the stock market, which has seen its share of wild rides. With the advent of trading apps that allow anyone to buy and sell shares with a few taps on their smartphones, the barrier to entry has vanished. It’s become a playground for both seasoned investors and novices hoping to catch the next big wave. But with this democratization of trading comes a significant risk. Many are unprepared for the volatility and complexity of the market, leading to financial losses that can reverberate for years.

Let’s not forget the influencers, who have become modern-day financial gurus. They’re selling everything from courses on how to invest to “get rich quick” schemes that promise to transform your bank account. Their charisma and polished personas often mask the reality of their own financial journeys, leaving followers dazzled but unaware of the potential pitfalls. It’s a classic case of buyer beware, as many fall into the trap of thinking that success is just a purchase away.

In the midst of this cash frenzy, there’s an underlying tension—an acknowledgment that not everyone will come out ahead. The pressure to keep up with the Joneses is palpable. Social gatherings have transformed into showcases of wealth, where conversations revolve around investment strategies and recent gains. It’s all fun and games until the reality sets in that not everyone can maintain this pace. Many are left grappling with anxiety and feelings of inadequacy as they watch others thrive while they struggle to make ends meet.cash frenzy

As the frenzy continues to grow, it’s essential to take a step back and evaluate the long-term implications. Quick cash may seem like a dream come true, but what happens when the tide turns? The key lies in understanding the balance between risk and reward. Financial literacy has never been more critical. It’s vital to educate ourselves on the intricacies of investments and the importance of building a sustainable financial future rather than chasing fleeting trends.

Ultimately, the cash frenzy is a double-edged sword. It’s a testament to the power of innovation and opportunity, but it also serves as a reminder of the inherent risks that accompany such rapid change. The allure of instant wealth is tantalizing, but it’s essential to approach it with caution and a clear head. cash frenzy

So, as we navigate this financial landscape, let’s embrace the excitement of the cash frenzy while remaining grounded in reality. Wealth may be tempting, but wisdom is invaluable. In the end, the true measure of success lies not in the size of our bank accounts but in our ability to make informed decisions that lead to lasting financial well-being.cash frenzy

Fale conosco. Envie dúvidas, críticas ou sugestões para a nossa equipe através dos contatos abaixo:

Telefone: 0086-10-8805-0795

Email: portuguese@9099.com