whatsapp pix 🎬 WhatsApp Pix: A New Era of Financial Transactions in Brazil

WhatsApp Pix: A New Era of Financial Transactions in Brazil

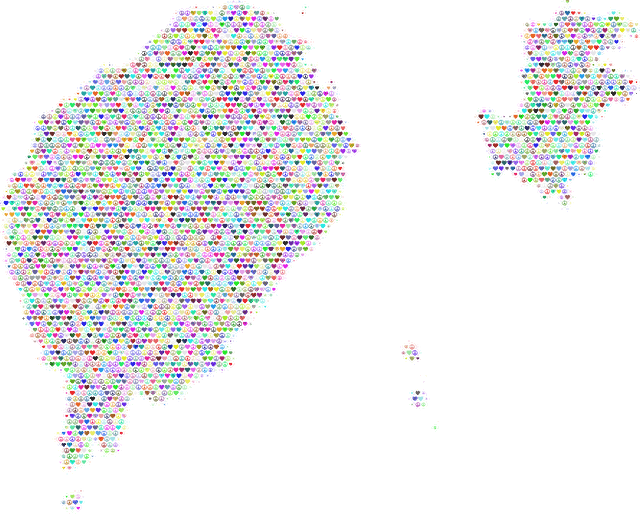

In recent years, the landscape of financial transactions in Brazil has undergone a significant transformation, largely propelled by advancements in technology and the increasing integration of digital platforms into everyday life. Among these innovations, the partnership between WhatsApp and the Pix payment system stands out as a pioneering development that promises to reshape how Brazilians conduct financial transactions. This report delves into the intricacies of WhatsApp Pix, exploring its implications for users, the economy, and the future of digital payments in Brazil.

The Pix system, launched by the Central Bank of Brazil, has revolutionized the way individuals and businesses transfer money. With its real-time transaction capabilities, 24/7 availability, and zero transaction fees, Pix has quickly gained traction across various demographics. The integration of this payment method into WhatsApp, a platform already used by millions of Brazilians for communication, marks a significant step towards enhancing user convenience and accessibility.

WhatsApp's user base in Brazil is among the largest in the world, with individuals using the app for personal and professional communication. By enabling Pix transactions directly through the messaging platform, users can now send and receive money seamlessly without the need to switch between applications. This integration not only simplifies the transaction process but also promotes financial inclusion by catering to users who may have limited access to traditional banking services.

The security of financial transactions is a paramount concern for users, and both WhatsApp and the Central Bank have taken measures to ensure that the new payment feature adheres to high security standards. End-to-end encryption, a hallmark of WhatsApp’s messaging service, extends to financial transactions, providing users with an added layer of protection. Furthermore, the Central Bank's oversight ensures that all transactions comply with regulatory requirements, fostering a sense of trust among users.whatsapp pix

However, like any technological advancement, the WhatsApp Pix integration is not without its challenges. The digital divide remains a critical issue in Brazil, with significant portions of the population lacking access to reliable internet services and smartphones. As the country continues to progress towards greater digital inclusion, it is essential that efforts are made to bridge this gap, ensuring that all Brazilians can benefit from the conveniences of modern payment systems.whatsapp pix

Additionally, the rise of digital transactions brings with it the need for increased awareness and education surrounding cybersecurity. Users must be informed about potential risks associated with digital payments, such as phishing scams and unauthorized access to personal information. As financial literacy becomes increasingly important in the digital age, educational initiatives targeting both the youth and older generations will be essential in equipping individuals with the knowledge necessary to navigate the evolving financial landscape safely.

Furthermore, the integration of WhatsApp Pix has the potential to stimulate economic activity, particularly for small businesses and entrepreneurs. With the ease of receiving payments directly through a widely used communication platform, small business owners can streamline their operations and improve cash flow management. This accessibility may encourage more individuals to venture into entrepreneurship, thereby contributing to job creation and economic growth.

In light of these developments, it is crucial to consider the broader societal implications of WhatsApp Pix. The ability to conduct financial transactions with ease can foster a culture of transparency and accountability among users. As more individuals engage in digital payments, the potential for tracking and analyzing financial behaviors increases, which can lead to improved financial decision-making and responsible spending habits.whatsapp pix

As we look to the future, the success of WhatsApp Pix will largely depend on how effectively stakeholders can address the challenges associated with digital payments. Collaboration between the government, financial institutions, technology companies, and civil society will be vital in creating an inclusive ecosystem that empowers all Brazilians to participate in the digital economy.whatsapp pix

In conclusion, the introduction of WhatsApp Pix represents a significant milestone in Brazil's journey towards a more inclusive and efficient financial system. By leveraging the popularity of WhatsApp and the innovative features of the Pix payment system, this integration holds the promise of transforming everyday transactions for millions of users. However, it is imperative that all individuals are equipped with the necessary tools and knowledge to navigate this new landscape safely and effectively. As Brazil embraces this digital revolution, the commitment to fostering financial inclusion, security, and education must remain at the forefront of discussions surrounding the future of payments in the country.

Fale conosco. Envie dúvidas, críticas ou sugestões para a nossa equipe através dos contatos abaixo:

Telefone: 0086-10-8805-0795

Email: portuguese@9099.com